Florida Solar Tax Credit 2020: Step By Step Guide

All Home Solar Purchased In 2022 Will Receive a 30% Federal ITC Tax Credit for Qualified Homeowners!

Florida Solar Tax Credit 2020 Step By Step Guide explains exactly how the Federal

Solar Tax Credit Works? More importantly, learn if it will work for you?

Any tax credit earned by installing solar ( The Investment Tax Credit ) (ITC), allows you to deduct 26% percent of the cost of installing a solar energy system from your federal taxes in 2020 and 22% in 2021. The ITC applies to both residential and commercial systems, and there is no cap on its value.

Step One: How The Tax Credit Works

The investment tax credit for solar systems in Florida is 26% in purchased in 2020 and 22% purchased in 2021. If your system is $20,000 Florida Solar Tax Credit in 2020 is $5200. The net cost of your system is $14,800. How do you actually receive that $5200 is the real question?

Here’s how the Federal tax credit works, you deduct the tax credit from your actual taxes owed or prepaid. So if you owe or have prepaid $5200 in taxes for the year 2020 and your tax credit is $5200, you owe nothing in taxes. If you prepay your taxes then you will get a $5200 refund.

Now if your taxes were $2,100 and your tax credit is $5200 you can carry forward the difference for up to five years. Although you saved $2100 in 2020 you can still deduct the tax credit the next year. You can use the tax credit until you have reached $5,200 but you have only five years to exhaust it. After 5 years if there is any unused claims for any part of the tax credit it’s UN-claimable.

Step Two: Understanding The Best Time To Purchase Solar To Benefit From Solar Tax Credit

You’re better off purchasing your system during a high earnings year because of financing interest. For a multitude of reasons not only because you can receive your tax credit all at the same time next tax season. In a high earnings year, you can buy your Solar System for cash and possibly realize as big a savings if not bigger than the tax credit. Because when you pay in cash the savings on Interest and closing costs ($2,500 on average) are quite substantial in addition to the tax credit savings. It’s important to act now because the Florida Solar Tax Credit 2020 is 26% but will be 22% in 2021.

To determine if you qualify for the tax credit the following is an example of how it actually works.

The tax credit is exactly what the name implies. It’s a credit toward income taxes owed or pre-payed. so if you have a tax credit for $5000 and your income taxes owed or pre-payed are $5000 then you will owe no taxes and if pre-payed you would get a refund for $5000.

If you owed no taxes you do not qualify for the tax credit, but you can use the credit for up to five years. Once again because no two peoples taxes are the same, I highly recommend for you to consult whoever does your taxes about including the ITC Tax Credit (IRS Form 5695) In your income tax filings. See more below….

Cash Is King When It Comes To Solar

The truth is if you can afford to pay cash, solar is a no-brainier because you’re saving money every month. Your saving money every month for the next twenty-five years or longer. This doesn’t mean a financed system is not a good investment. If you buy right even financed systems offer huge savings because you’re paying the power company every month.

Step Three: Be Cautious of Solar Companies Including The Tax Credit In The Deal

When a solar company is presenting you a solar proposal quite often they’ll include your tax credit in the deal. This is important to know because they can’t control if you qualify for it or when or how you receive your tax credit. They also can not control what you do with your tax credit, only a tax expert should be consulted to determine if you qualify for it. Should your tax credit be included in your deal it is then expected for the buyer to pay that tax credit to the finance company. The trick they use to disguise what their up to is your loan is interest-free for the first 15 months. Then all of sudden because you didn’t pay that tax credit money toward the solar system the payments go up.

Most Purchases of Solar Financed Receive 2 Different Payments From Solar Companies

In many cases the homeowners agree to pay the tax credit to the finance company or their solar payment will be higher than your power bill they’re off-setting. Most financed deals give you interest-free for the first year. The reason is you don’t receive a tax credit for up to a year from the time of purchase. So the finance company wants to give you ample time to include your tax credit into the deal to lower your payments. The idea being to off-set what your power bill was and to help you to realize immediate savings.

The problem is a lot of people don’t understand this part of buying solar. Basically the solar companies use your tax credit as a down-payment for your purchase. But what happens if the next tax season the homeowner finds out they don’t qualify for the tax credit? Their finance payment could be much higher than their power bill was before solar. It does not mean it was a bad purchase it just means it will cost 26% more than they anticipated when purchasing the solar system.

If you don’t pay the tax credit money to the lender your system becomes a 100% financed system because there’s no down-payment. Basically the solar companies use your tax credit as a down-payment for your purchase.

Step Four: How Do I Apply for And Receive My Solar Tax Credit?

An uncapped 26% federal tax credit on residential solar electric (PV) systems remains in effect through the end of 2020. Because the tax credit goes to 22% next year now is the best time to go solar for the lowest cost. In 2021 the tax credit is 22%, and then the tax credit ends completely at the end of 2021.

Include The Tax Credit In Your Tax Filings

This is how you receive the tax credit. Include IRS Form 5695 when you file your taxes. Here is the link for Tax Credit Instructions.

Also, use Form 5695 to take any residential energy efficient property credit carry forward from 2018. Or to carry the unused portion of the credit to 2020. You may be able to take the credits if you made energy-saving improvements to your home located in the United States in 2019.

The Majority of Solar Panels Do Come With a 25 Year Manufacturer Warranty

The biggest challenge is that most folks don’t believe that solar panels will last for twenty-five years or more? The truth is they are designed to last for forty years or more and are storm tested.

The best clue you have for how long solar panels last is the power companies are using the exact same panels. They wouldn’t be making such a sizable investment into solar farms if the technology wasn’t sound. Also, the banks wouldn’t do 20-year financing if the equipment didn’t last that long.

So if a solar payment is at or below your power bill there really is no reason not to go solar. But if you buy your equipment wholesale, the cost of solar is substantially less and you can make a profit.

At a minimum, you’re helping the environment with no additional expense by off-setting power bills. Buy right and you will more than likely realize substantial savings by going solar.

The business model is predatory by nature and as a result, the consumer of solar has no advocacy to lean on. It’s almost like a conspiracy because if you go online to research home solar it’s the solar companies providing all the knowledge and information. The information you find online is all about federal tax credits, payments that offset your power bill so solar is free, financing solar, or very inaccurate return on investment information.

ROI is dictated by one thing and one thing only and that is the price you pay for a solar system. The manor in which these solar companies operate is sucking all the ROI for the customer out of the front end of the sale. The companies are getting the benefits not the purchaser of the home solar system.

Check Out Florida Solar Tax Credit because not everybody has enough income to qualify for the ITC. (Earned Income Tax Credit)

Don't Buy Solar - Invest In Solar

It’s my belief there is a need for a revolution in how solar is marketed. That’s why I founded “Your Solar Advocate” because it’s a better way to go solar, and best of all, it’s a free service.

“Your Solar Advocate” represents the homeowner’s best interests and, in doing so, puts the ROI in the consumer’s pocket. This is critical if solar will overcome the public resistance to home solar because of the poor return on investment. 95 out of every 100 potential solar buyers have said no to home solar, and it wasn’t because they didn’t want it. They said no because the prices they’re being quoted are too high.

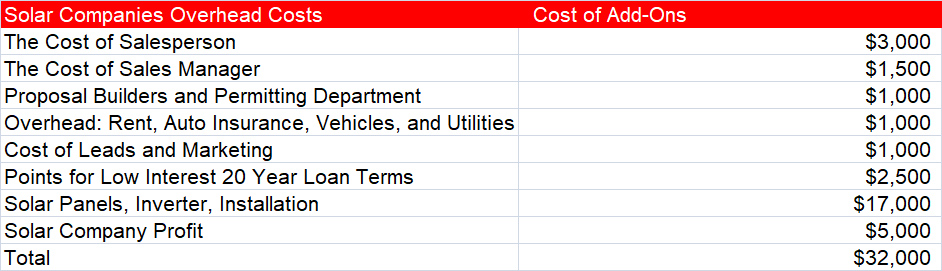

How can it be justified that the Permit, Plans, Installation, and equipment cost a company $17000, and they charge $32,000? It’s because of too many hands in the pot; far too many solar companies’ overheads are excessive.

“Your Solar Advocate” is the best way to make home solar profitable for the homeowner. “Your Solar Advocate” puts all that wasted overhead costs into your pocket where it belongs! With “Your Solar Advocate,” you have expertise at your fingertips every step of the process of going solar.

A Typical Solar Company's Proposal

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of Salesperson | $3000 |

| Sales Manager | $1500 |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | $1000 |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) |

$2500 |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | $5000 |

| Total | $32,000 |

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of a Salesperson | |

| Sales Manager | |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) | |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | |

| Your Solar Advocate Target Price $2.75 a Watt Totals for 7K | $19,250 Tax Credit – $5,005 The net Cost Is $14,245 |

"Your Solar Advocate" Has a Target Price for a Complete End To End Home Solar System for $2.75 Per Watt Installed In Florida!

“Your Solar Advocate” provides Upfront Pricing before you meet with a home solar contractor. This will give you something to compare against any other home solar proposal you receive. Our service is free, and you can use it to determine what will work best for you. Many solar contractors in Florida don’t like to provide the most important information without meeting you first and running a credit check. Avoid dealing with high-pressure sales techniques to get the answers to your questions. Our service reverses the process of going solar by providing upfront pricing directly from the contractor without all the structural costs of managers and sales managers. We get you the very best pricing from the very best home solar contractors, and the process is completely transparent. Please complete the form and provide your address and daily kilowatt consumption to receive an accurate solar system price in advance of any meeting.