The Truth About Solar In Florida

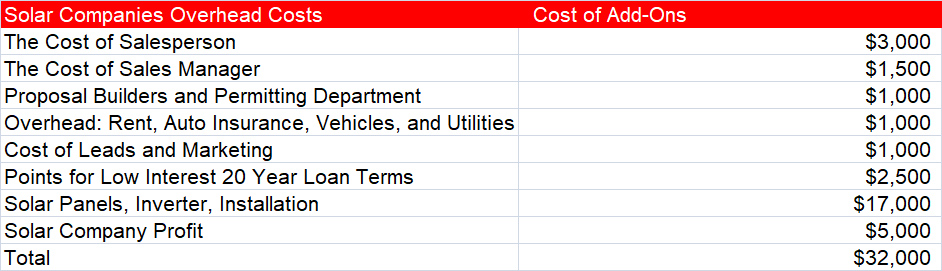

The Truth About Solar in Florida is the price solar companies charging is over-inflated. It’s tough to get a deal on solar in Florida because every solar company has to add on an additional $7000 or more to every deal.

That’s $7000 over the cost of solar panels, equipment, and Installation just for the company to break even. For a breakdown of the cost totals, check out “Can I Do My Own Solar.”

A Suspect Business Model

The truth about solar in Florida is the solar companies use a business model similar to car dealerships. They use high-pressure sales techniques; they may appear passive but trust me, they are using subtle but effective sales methods—the sales staff trains morning, night, and day specializing in selling solar.

Home solar prices should be lower because the customers pay for unnecessary overhead costs that inflate the price. Unfortunately, most of these extra costs are not paid out by solar companies until they get paid, either in cash or by the finance company.

As a result, all the additional costs are just for them to break even on any deal. So now, these companies are adding $5000 to every deal for a profit. That comes to a total of at least $12000 added to the cost of the panels, equipment, and installation on every deal.

The Cost of Solar Systems Have Been Over-Inflated in Florida

The salespeople are not trained to lie, but many of them do to get the sale. The state of Florida lacks any form of advocacy for the buyers of home solar. I would describe it as the wild west of solar, there is no consumer protection to speak of, and that’s a crying shame.

Home solar is great and a good investment so long as you’re not paying an exorbitant price. If you buy solar right, it pays for itself in 5 to 9 years with the same money you would have paid in electric bills. After 5 to 9 years your generating free home electricity, the system is designed to last 25 years or more.

Solar Is A Sound Investment

15, 20, or 25 years of free power is a really nice return on investment. That’s why solar is an excellent investment, but you must buy it right.

Whatever you do, don’t finance home solar for twenty years because it’s not a good return on investment. Suppose you’re going to go solar, then checkout “Your Solar Advocate,” a solar consulting firm. They walk you through every step of the process, including buying your equipment wholesale.

Just writing this article makes me realize why less than 2% of Florida homes have solar. That’s a tragic statistic because solar is incredibly helpful for the environment.

Something has to give, and I do know for a fact that homeowners can now save an absolute minimum of $6000! This idea should get the ball rolling for “a better way to go solar” in Florida. The rate of solar installations in Florida is dismal compared to many states that don’t have as long a day. “Your Solar Advocate” is the best idea to get the ball rolling to help Florida become a leader in solar technology.

A Typical Solar Company's Proposal

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of Salesperson | $3000 |

| Sales Manager | $1500 |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | $1000 |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) |

$2500 |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | $5000 |

| Total | $32,000 |

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of a Salesperson | |

| Sales Manager | |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) | |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | |

| Your Solar Advocate Target Price $2.75 a Watt Totals for 7K | $19,250 Tax Credit – $5,005 The net Cost Is $14,245 |