The Benefits of Solar in Florida are as follows:

- The majority of homes in Florida have excellent sun exposure for good productivity

- Every home is paying a power bill every month that can be offset with solar power.

- 26% Tax Credit in 2020 and 22% in 2021 zero tax credit in 2022

- The return on investment is exceptional you can save up to 63% off present power costs for the next 25 years

- The laws are written in the homeowner’s favor

- Clean Energy is healthy for the environment for thousands of years to come

- Homeowners produce solar for a lower cost than the power companies do

- “Your Solar Advocate” Free Consulting Service walks you through every step of going solar by eliminating unnecessary overhead costs

Homes In Florida Have Enough Sun Exposure for a Productive Solar System

Having enough sunlight is one of the most obvious benefits of home solar in Florida, but it’s not for every home. Should you have a home with a meager power bill, then solar probably will not be cost-effective. It’s possible to benefit if the cost of a solar system is low enough, but the benefits are greater the more power you use. A good standard is if your bills averages are $120 or more a month.

Naturally, if a home has a great deal of tree coverage, it can get costly trimming or removing trees for solar to be effective. But solar can be installed in any sun-exposed areas on the majority of properties and be productive. All these different methods really do require some help from an expert. So it’s imperative to get it right from the beginning.

All Homes Have a Monthly Power Bill to Offset The Cost of Solar

Because every home has a power bill, homeowners can use that money toward solar and ultimately own their own power company. Of course, it’s nice to offset the cost of solar using the power bill money to pay for it, but additional savings are available.

The federal ITC tax credit gives homeowners in Florida an automatic 26% percent tax credit thru 2022. Learn more about the Federal ITC Tax Credit that applies to solar Florida Solar Tax Credit 2022.

Homeowners are producing lower-cost power with solar than power companies. This is because the power companies have to lease or buy land and build platforms for the panels. Homeowners don’t have any of these additional expenses. Power companies then have to mark up the cost of the power produced from solar. This is important information to give us an insight into how power companies are going to pass those costs in the future on to the customer.

Excellent Return On Investment

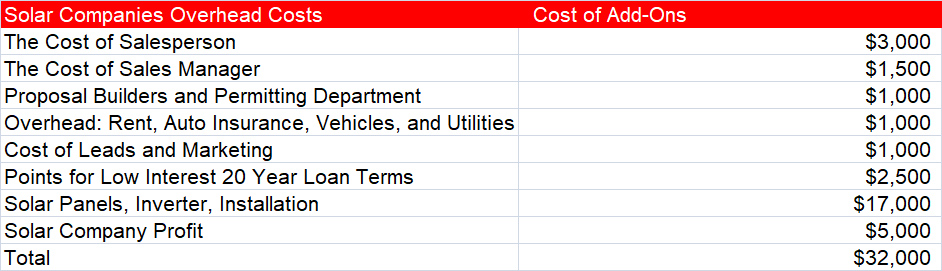

A Typical Solar Company's Proposal

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of Salesperson | $3000 |

| Sales Manager | $1500 |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | $1000 |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) |

$2500 |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | $5000 |

| Total | $32,000 |

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of a Salesperson | |

| Sales Manager | |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) | |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | |

| Your Solar Advocate Target Price $2.75 a Watt Totals for 7K | $19,250 Tax Credit – $5,005 The net Cost Is $14,245 |

A 7K Solar System can offset approximately $150 in power per month. 25 years of power is 300 months that totals $45,000 in power costs for 25 years.

Buying home solar at retail prices can be as much as 4.50 a watt whereas using “Your Solar Advocate” has a target price of $2.75 a watt ($1.75 a watt in pricing is an amazing spread)

7K system is $32,000 with a tax credit of $8,320 for a net total cost of $23,680

7K system at $2.75 a watt is $19,250 with a credit of $5005 for a net total of $14,245.

At today’s current power costs of $150 a month totaling $45,000 for 25 years minus $14,245 net solar costs equals a savings of $30,755

Solar-produced energy isn’t taxed and Florida law prohibits home improvement property tax increases.

A bonus is Cleaner Air To Breathe for generations to come.

Federal ITC Tax Credit Is 26% of The Total Cost for Qualified Buyers

Getting the right experts combined with lower cost of equipment all but guarantees home solar in Florida is an excellent investment. The key is to eliminate the ridiculous overhead solar companies are passing on to you. That’s where “Your Solar Advocate” comes in, helping you get the best savings possible and getting a great ROI.

The Laws and Rules are in the Property Owners Favor

Under no circumstances can a homeowner be denied going solar in Florida. Renewable energy can not be regulated by a homeowner’s association. Homeowners association should always be made aware of when a home is getting solar installed.

Florida solar laws require that the power companies co-operate with homeowners using the grid for service and power storage.

Florida does not allow any new tax assessment for home improvement with solar. Although many large consumption homes can improve the value of their home with a solar system, their property taxes will not increase.

You can not be denied by communities or homeowner associations but you should always notify them your installing solar.

If you would like to speak with an expert solar advisor for free simply fill out the basic info form below and we will contact you within 24 hours.