Do I Need To Finance Solar

Do I Need To Finance Solar: Explained is an in-depth look at how and why financing is at the forefront of the solar revolution. The majority of companies are hyper-focused with financing.

The solar industry is structured with specialty lending companies that have researched the products the industry offers. In the majority of cases, these loans are low-interest twenty-year terms. These lending institutions have very strict enforcement guidelines for qualifying buyers because of the twenty-year term.

Financing solar equipment slows down the “Accelerated Savings Rate of Power Costs” for the homeowner.

Companies who predominately rely upon this option are putting their own short term gains ahead of the homeowner’s long term benefits.

Easier To Sell a Payment Than The Cost of a Solar System

The reason all the solar companies use these finance companies is that most homeowners can’t afford to pay cash. Another reason is that they can sell the buyer a payment instead of the actual cost of a system. The homeowner is less resistant with a loan payment because they don’t have to put any money down and they’re saving the power bill money. But by the time they pay it off because of a 20-year loan and the system can become antiquated, which means it’s a wash when they could have made tens of thousands of dollars.

Solar Companies Pass Expenses On To The Customer

The biggest reason why solar companies love financing is that it is the same as getting paid in cash upfront. The deal is funded by the finance company within 5 days. Solar companies don’t pay for anything until they have the funds other than their facility and a couple of employees.

Your better off getting your own financing in the majority of the cases. The loan you receive from a solar finance company is 5% simple interest so it sounds like a really good rate. That simple interest loan over twenty years ends up doubling the cost of a home solar system. The solar company doesn’t tell you that they pay $2500 in points to get that low-interest loan. They don’t tell you because your the one paying the closing costs and they know you wouldn’t agree with that. The closing costs get buried in the deal and are not revealed to the customer.

Solar Buyers Get Better Deals Getting Their Own Financing

There are more ways than I can count to get financing but many homeowners just get a traditional loan and pay-off their system quickly. When you pay-off a solar system quick you get a better return on investment. So in the ideal scenario, it’s best to pay cash upfront and reap the maximum benefits of solar.

At the end of the day, you are working with the power company’s money with minimal risk but great upside potential. In 2020 because of the unprecedented low-interest rates, there never will be a better time to refinance your home with home improvements included. You’ll probably get the solar free because your mortgage payment will not increase due to the lower-interest.

The obvious thing about financing solar is it raises your cost of a solar system. It’s wise to trim those costs as much as possible so your solar system will be profitable.

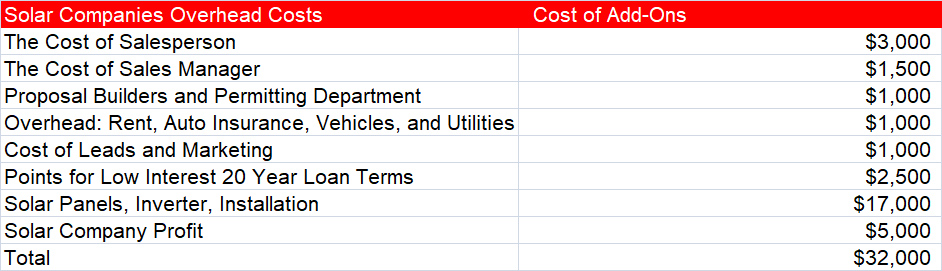

A Typical Solar Company's Proposal

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of Salesperson | $3000 |

| Sales Manager | $1500 |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | $1000 |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) |

$2500 |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | $5000 |

| Total | $32,000 |

| Add-Ons To Every Solar Proposal | Cost of Add-Ons |

| The Cost of a Salesperson | |

| Sales Manager | |

| Proposal Builders and Permitting Department | $1000 |

| Overhead: Rent, Auto Insurance, Vehicles, and Utilities | $1000 |

| Cost of Leads and Marketing | |

| Points for Low Interest 20 Year Loan Terms (Frequently Hidden Cost) | |

| Solar Panels, Inverter, Installation | $17,000 |

| Solar Company Profit | |

| Your Solar Advocate Target Price $2.75 a Watt Totals for 7K | $19,250 Tax Credit – $5,005 The net Cost Is $14,245 |